After today’s unexpected referendum result to leave the EU, UK buyers are asking about the repercussions when buying property in Austria. Below we have listed a few pointers which may help when deciding to invest in Austrian property.

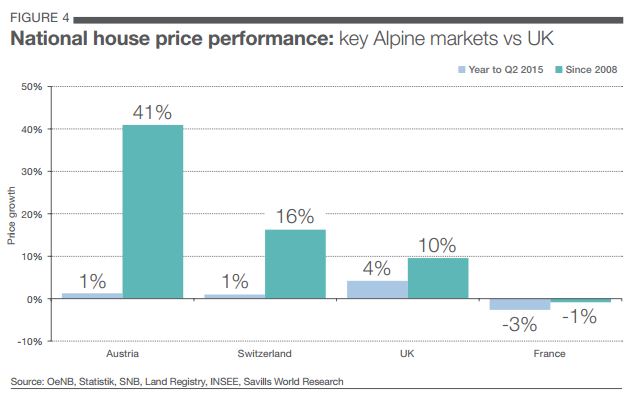

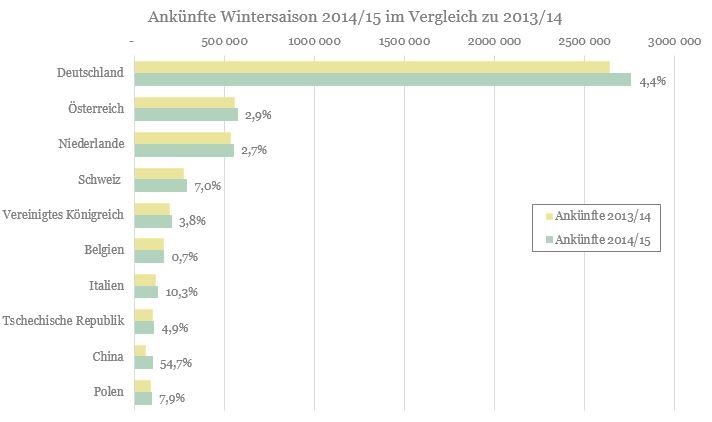

2016 is still a good time to invest in Austria: this year Austria will receive another record number of summer and winter tourists from inside and outside the EU which will drive local investment in tourism infrastructure and support growth in rental income by our fully-managed rental programme. On the back of these positive numbers we predict the solid capital growth within the Austrian tourism property market to continue: 16.5% in the last 4 years versus a fall of 5.7% in France (source: Knight Frank, June 2016).

No real change for UK buyers in the short term: if Article 50 is triggered by the UK government, we predict no change for the following two years as we negotiate our exit and trading relationship with the EU. Purchases before conclusion of the exit will not be affected retrospectively – once you are in Land Registry your ownership cannot be reversed. UK buyers should always consider the Sterling / Euro exchange rate to ensure they negotiate a good deal when converting their currency but there are many outside factors which affect the exchange rate and we predict Sterling will strengthen once the uncertainty has been removed.

Non-EU citizens are already buying our Austrian properties: should a UK buyer’s status in Austria change once we have left the EU, non-EU citizens may buy Austrian properties through limited companies with a registered office inside the EU and there is no requirement for the shareholder to be a European citizen. Furthermore, with 1.2m UK citizens living in EU member states and 2.9m EU citizens living inside the UK, we predict both the EU and UK governments will agree a fair deal for both sides without delay.

Tax: the UK has an extensive network of international double tax treaties. The double tax treaty with Austria will remain unaffected. To provide balanced and accurate advice to our clients, Kristall Spaces has negotiated a very reasonable tax package with an Austrian accountancy firm specialising in tourism rental properties. UK buyers may engage the tax advisors at the time of purchase to ensure a seamless registration with the Austrian tax authorities and advise on local tax issues during the purchase and process VAT rebates and tax returns.

Mortgages: Austria has always welcomed British buyers who invest in their tourist destinations. All Kristall Spaces apartments come with a rental obligation and the tax authorities waive the 20% VAT on the purchase price in return for your agreement to rent the property and support the growing numbers of visiting tourists to the resort (40million people per annum). Your property is classified as a small business and the rental income may be used to service a mortgage with a local bank. Financing a part of your purchase in Euros and servicing the mortgage with Euro rental income acts as a ‘hedge’ against Sterling / Euro exchange rate fluctuations.

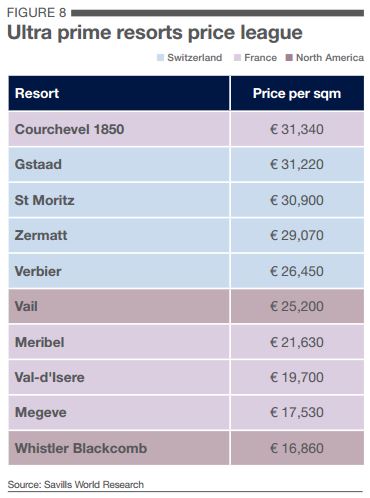

About Kristall Spaces ski properties: we carefully choose our developments in high demand locations so they sell out fast (95% before construction is complete). We have an international mix of owners from inside and outside of the EU who choose our ski apartments (average Price per sqm € 5,500 – except St Anton € 11,500) based on their affordability compared to Swiss and French resorts, access to high altitude slopes / glaciers and increasingly their dual season status (Oetz receives nearly as many visitors in summer as winter).