There are some useful data in this year’s Savills report on Alpine properties – here are the out-takes for buyers considering property in Austria.

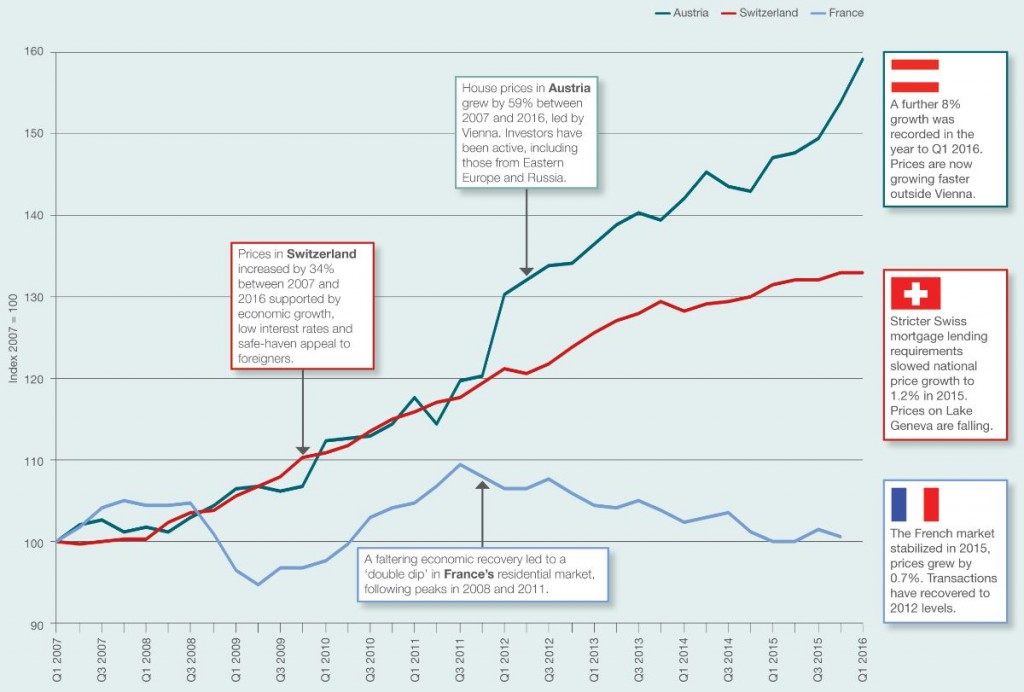

Austrian ski property prices are 28% below other alpine countries but price growth is higher at 8%. See the chart below.

With ongoing infrastructure investment and growing international skier participation there is room for upward price movement in Austria. Other sources (e.g. Tiroler Tagezeitung) recently highlighted a record first half in 2016 of apartment sales in Tirol with an average capital growth of 6.2% for the region.

Reassuring feedback then from separate sources on increasing asset values which will be sustained by careful town planning restrictions on over-development and therefore supply.

Austria is clearly more successful than France and Switzerland in developing its non-skiing attractions and summer tourism business which drives up rental yields, infrastructure investment and future resale values for Austrian property owners.

The report points to a 1.6% year-on-year decline in total ski visits to the top 8 global markets is reported (USA, France, Austria, Japan, Italy, Switzerland, Canada and Germany).

Austrian property investors need to be careful and review local tourism figures in isolation.

The Tirol region has delivered a >10% increase in visits in the first 6 months of 2016 clearly bucking the trend of competitor ski markets.

Innsbruck airport is increasing its inbound capacity for German passengers by 180% this year and introducing new routes from British Airways. The Tirol Tourism board and the ski resorts are again forecasting a year-on-year growth in visitor numbers.

One successful strategy paying off for the Austrians is their focus on the millennial generation (age 20 to 35). The successful Alpine resorts of the future will be the ones which innovate and draw new visitors with different activities throughout the year.

Examples include Kühtai which boasts Austria’s biggest half pipe and nearby Area 47, one of Europe’s largest extreme sport adventure parks which even has a wakeboard park at 812m above sea level and Mediterranean water temperatures to boot:

Ischgl is one of the biggest ski areas with the longest season continually ploughs lift profits back into its dizzying array of slick infrastructure and glitzy / urban amenities, including 3 Michelin star restaurants. In Ischgl you can even ‘fly home’ down the valley with or without skis at 85kmh on a dual zip wire – 2km long and 50m high (total investment €2m):

Incredibly, family-friendly Oetz has just reported a 30% increase in lift sales this summer thanks to new investment in family amenities in the Hochoetz ski area. Astonishingly, Oetz draws 45% of its annual visitors outside the winter season. Oetz has 80km of its own skiing and tourists can access Sölden in 20 minutes with its 2 glaciers but it has all-year round tourism status – not just in the Summer but through to early Autumn when the Acherkogelbahn makes a brief pause before the Winter season starts again on 16 December.

Hochoetz’s new adventure playground, Widiversum – parents can even leave children in supervised groups and head higher into the mountains for the day:

Currency impact:

In the wake of the UK’s EU referendum and the weakening of sterling, Swiss Alpine property has become 8.6% more costly to GBP buyers (May to Sep 2016), while French or Austrian Alpine homes have become 7.6% more expensive. Despite the Pound’s fall, there are still some determined UK buyers who want to buy their Austrian property now and get into Austrian Land Registry before Brexit is finalised.

For US Dollar, Euro and Swiss Franc buyers, the picture is unchanged and the customer base is very international including non EU buyers as well as increasing numbers of Germans, Dutch, Belgian and Scandinavians.

Please read our FAQ about buying and owning an Austrian property or Contact us today with any questions.